HDFC Life Sanchay Plus - Long Term Income

While the previously mentioned HDFC Life Sanchay Plus (Guaranteed Income) was suitable for fulfilling many goals in your life, the HDFC Life Sanchay Plus (Long Term Income) plan assures you a steady income for a long period. As you approach retirement age, a great fear arises in your mind. Income is about to decrease suddenly. But expenses may not be able to be reduced suddenly accordingly. At this difficult time, another source of income will be a great blessing.

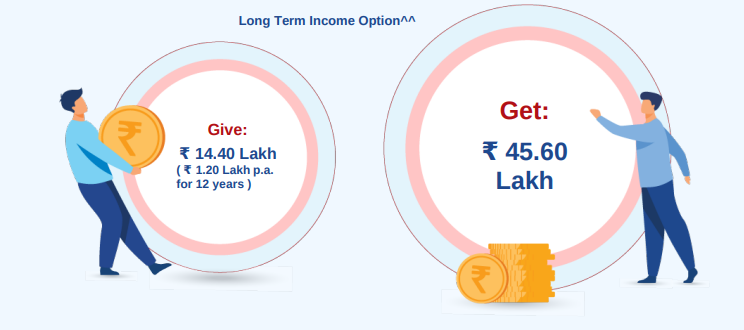

Let's see how the plan works.

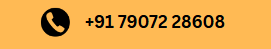

You pay ₹1,20,000 per year for 12 years, totaling ₹14,40,000.

From the next year onwards, you receive ₹1,24,800 annually for 24 years. (That is, you receive an additional ₹10,000 per month along with your salary or pension.) When totaled, you will have received an income of ₹29,95,200 over 24 years.

In the final year, when the income period of 25 years is completed (you will turn 76 in that year), along with the usual annual income of ₹1,24,800, you will also receive your invested amount of ₹14,40,000, totaling ₹15,64,800. With this, the plan ends.

Thus, when you invest ₹14,40,000, you receive an income of ₹45,60,000.

During the premium paying term (12 years) of this plan, the investor will receive insurance coverage. Additionally, the income will not be subject to income tax.

If you were thinking of joining any chit funds or other makeshift investment schemes, please stop for a moment. Please make a decision after evaluating the value of the HDFC brand, the security of your investments in HDFC, and the invaluable peace of mind and tranquility it will provide you in the future.

Under no circumstances should you fall into the trap of those who promise excessive interest, no matter how tempting. We must be able to distinguish between fraudsters and legitimate financial institutions.