Retirement Planning

Rethinking Retirement: Convert Obligations to Opportunities

A human life has two periods when one needs outside help and care: the first few years after birth and the last few years before death. In the first phase, childhood, this responsibility falls on the parents. In the second phase, old age, this responsibility was traditionally taken on by the children or their in-laws.

Availing Services on Payment Basis

However, global changes have forced people to make some adjustments to these responsibilities. If we look at the situation in Kerala, most of the babies are now born in countries like Ireland, England, the United States, Australia, and the UAE. This is because a large number of our youth have migrated to these countries in search of better living conditions. As a result, after a baby turns about six months old, parents have to depend on dedicated centers and individuals for childcare. This is, of course, a service that is sought on payment basis.

By the time these children are grown up and able to take care of themselves, their parents back home will have reached the second phase where they need care. Naturally, is there any other way to ensure their care than to seek a paid service?

Currently, there are two methods for elderly care in Kerala::

- Turning the home into a sanatorium and hiring home nurses and caregivers to provide the service.

- Booking a room or villa in a nursing home that operates with the facilities of a modern multi-specialty hospital well in advance and taking refuge there when care is needed.

By and large, our elders are reluctant to choose the second option. Most of them insist on breathing their last breath in the very home they worked so hard to build. All we can tell them is that if we change our approach as times change, we can make the final chapter of our lives a happy one. If we adopt the mindset that we shouldn't become a burden to our children, in-laws, or grandchildren in our old age, we will be able to make good decisions. Wouldn't it be a great help to our children if we make arrangements for all of this during our prime years?

Modern Old Age Care Centers in Kerala

This change reflects a broader cultural shift. In the past, people prioritized building a house; now, there's a growing trend to prioritize securing a spot in a well-regarded retirement community. The demand for these facilities is so high in Kerala that more are being developed, with some even offering options to book rooms or villas years in advance. (Read: 1. Top 10 Old Age Homes in Kerala 2. Care home occupancy swells by 67% in a decade in Kerala).

The Critical Role of Financial Planning for Retirement

At the heart of a dignified retirement is financial readiness. Without a solid financial plan, you may face significant limitations in a health crisis. Imagine needing to hire a home nurse or move to a care facility but lacking the immediate funds. Your assets may be tied up, and the process of liquidating them can be slow and complicated, potentially leading to financial distress.

This is why retirement planning is not a luxury but a necessity. It’s about building a dedicated corpus fund that can be accessed easily when you need it most.

HDFC Life's Retirement/Pension Plans

HDFC Life's retirement/pension plans are designed to help us embrace old age, an inevitable part of everyone's life, with dignity and to make the years leading up to becoming bedridden more enjoyable. HDFC Life has developed numerous plans that allow you to pay a large lump sum or in installments to receive a monthly pension. This pension can be passed on to your spouse for the rest of their life after your death, and after your spouse's death, the paid amount can be returned to a beneficiary. These plans can also return a portion of the paid amount if you are diagnosed with a critical illness. Many senior citizens are currently enjoying the benefits of these plans and living their retirement with great contentment.

How to Convert Obligations to Opportunities

While some retired government employees may already have a pension, a dedicated pension plan is essential for those who don't. These plans, like those offered by companies such as HDFC Life, are designed to provide a steady, reliable monthly income during retirement. Many of these plans offer features that ensure your spouse receives the pension for life after your passing and that the initial corpus is returned to your heir upon the demise of the spouse.

A smart financial move for adult children is to gift a pension plan to their parents. Upon the parents' passing, the corpus is returned to the children, who can then use it to fund their own retirement planning, creating a seamless cycle of financial security across generations.

Building Your Retirement Corpus: The Power of Starting Early

The key to a successful retirement fund is starting early. The longer you wait, the more you have to contribute to reach your financial goals. This is thanks to the power of compounding.

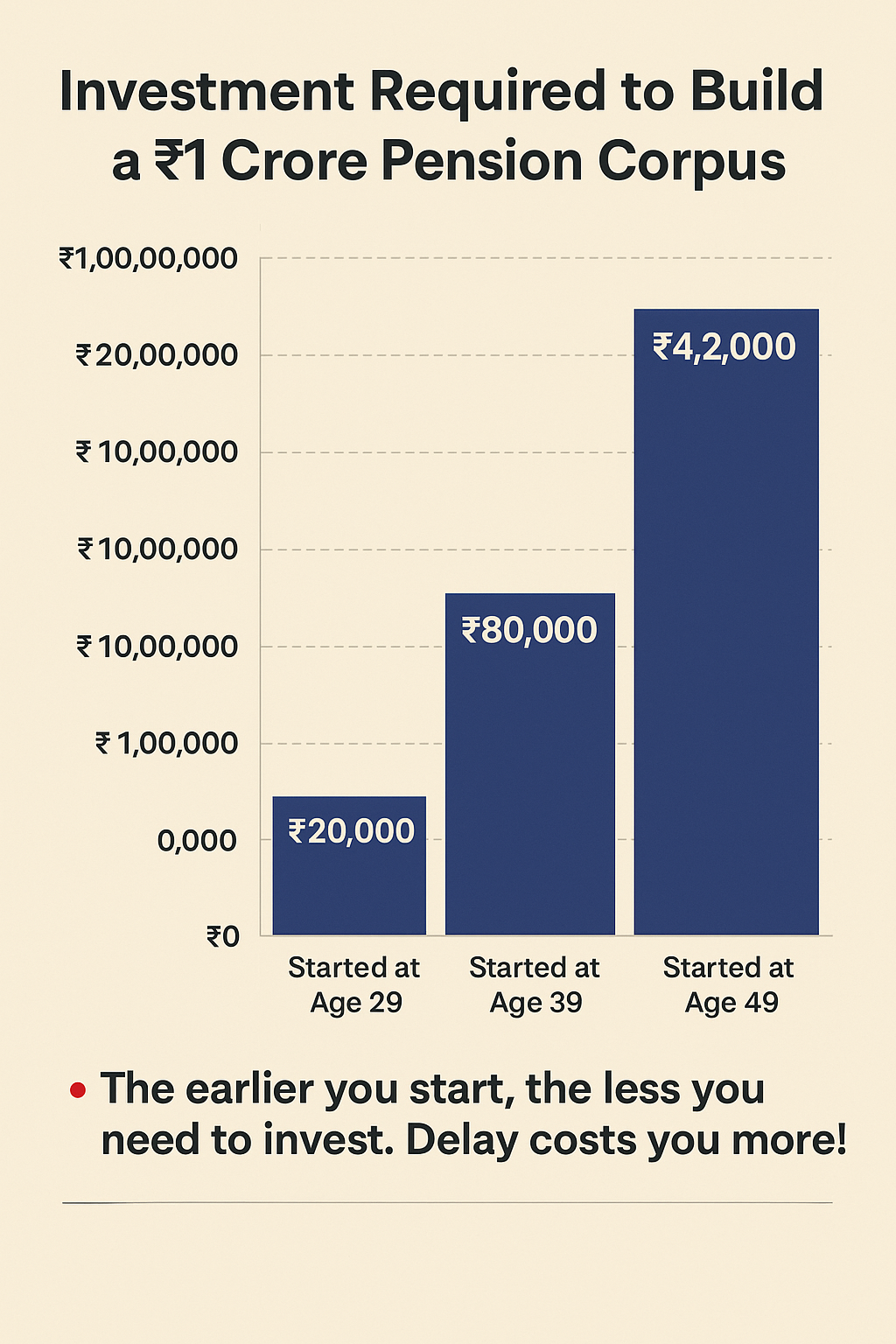

Let's look at an example to illustrate this: To build a ₹1 crore retirement corpus by age 60, a person who starts saving at:

Age 29:

would need to invest ₹20,000 annually for 30 years, totaling just ₹6 lakhs in contributions.

Age 39:

would need to invest ₹80,000 annually for 20 years, totaling ₹16 lakhs in contributions.

Age 49:

would need to invest ₹4,20,000 annually for 10 years, totaling ₹42 lakhs in contributions.

📌 As you can see, the later you start, the heavier the financial burden becomes.

In conclusion, retirement planning is a serious consideration for people of all ages. For older individuals, it's never too late to start. For the young, it's never too early. The best time to start planning for your retirement is right now.