The Power of Compounding in Building a Secure Retirement

Start early, stay consistent, and let time and compounding work for you!

A Real-Life Example

If a 60-year-old individual, along with his 55-year-old wife, invests ₹1 crore in HDFC Life’s Pension Guaranteed Plan, they will start receiving a monthly pension of ₹60,100 from the very next month.

After his demise, the pension continues for his wife.

After her passing, the initial investment of ₹1 crore will be paid back to the nominees.

This simple example shows how financial security and peace of mind can be achieved through the right pension planning.

Understanding the Power of Compounding

Compounding is based on the principle of “interest on interest.”

Your initial investment (principal) grows as interest is added.

That interest, in turn, earns more interest over time.

This creates a snowball effect where your money multiplies significantly over the years.

👉 Pension Plans, Mutual Fund SIPs, and other long-term investments rely on this principle.

To maximize compounding benefits:

✅ Start early

✅ Be patient

✅ Stay consistent

Time becomes your greatest ally in building wealth!

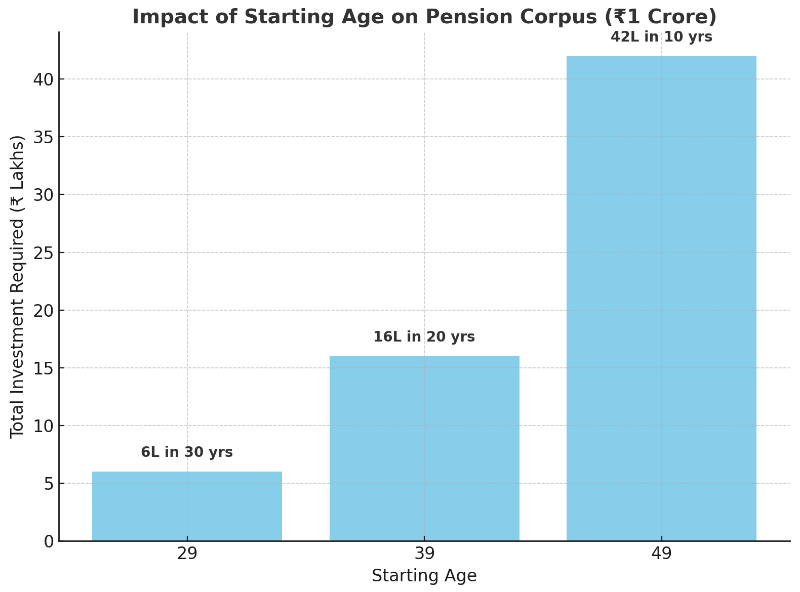

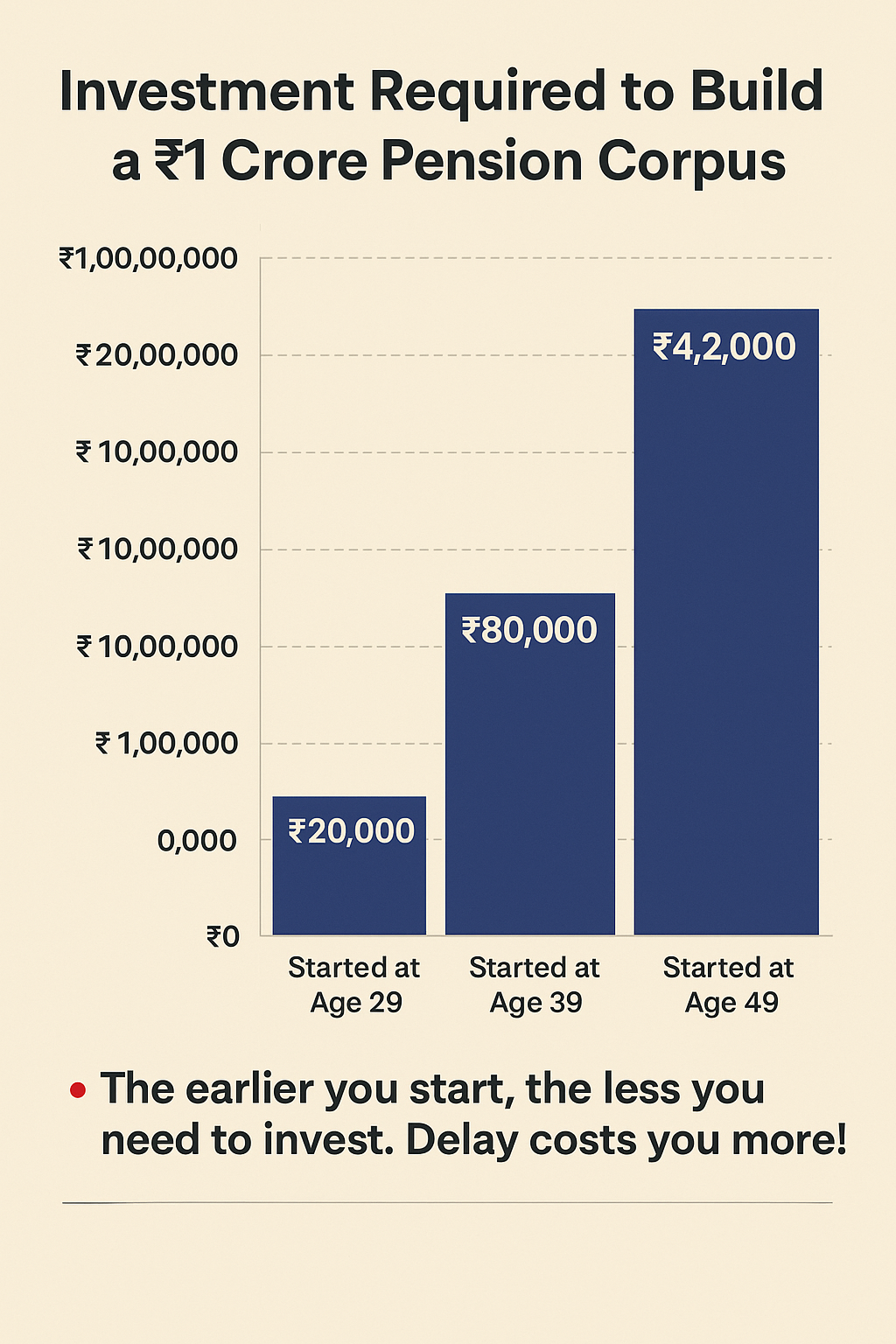

How Early Investing Makes a Difference

Let’s look at the same 60-year-old gentleman who managed to build a pension corpus of ₹1 crore:

Started at Age 29:

Invest ₹20,000 per year for 30 years (₹6 lakh total) → Corpus grows to ₹1 crore

Started at Age 39:

Invest ₹80,000 per year for 20 years (₹16 lakh total) → Corpus grows to ₹1 crore

Started at Age 49:

Invest ₹4,20,000 per year for 10 years (₹42 lakh total) → Corpus grows to ₹1 crore

📌 The earlier you start, the less you need to invest. Delay costs you more!

A Financial Priority Order for Young Earners

To achieve financial discipline and long-term stability, it’s wise to set your priorities in this order:

1. Protection/Life Insurance

Protect your loved ones first.

(e.g., HDFC Life Click 2 Protect Super)

2. Pension/Retirement Plans

Secure a stress-free retirement.

(e.g., HDFC Life Immediate Annuity, Guaranteed Pension Plan, Systematic Retirement Plan, Pension Guaranteed Plan)

3. Health Insurance

Protect against rising medical costs.

(e.g., HDFC Life Click 2 Protect with health benefits, HDFC ERGO Optima Secure)

4. Investments

Build wealth only after securing protection.

(e.g., HDFC Life ULIP plans, Mutual Funds)

Conclusion

Financial discipline, when combined with the power of compounding, can create lifelong financial security.

🌸 This Onam, let’s pledge to start early, stay consistent, and build prosperity for ourselves and our loved ones. 🌸

📢 Take Action Today!

Begin your pension planning early.

Secure your life and health with adequate insurance.

Let compounding work its magic over time.